Here’s how to Get Started

Effortlessly unlock business success by connecting with a dedicated Advisor, receiving a personalized Technology Roadmap, and focusing on business growth with your technology needs in capable hands.

Schedule a Call

Talk with a dedicated Advisor who can help you assess your company so that you can know exactly what your needs are.

Get a Free Roadmap

After your call, we will send you a personalized Technology Roadmap to help you discover the solutions that are right for you.

Grow Your Business

Now that your technology needs are being handled, you can focus on running your business and staying ahead of the competition.

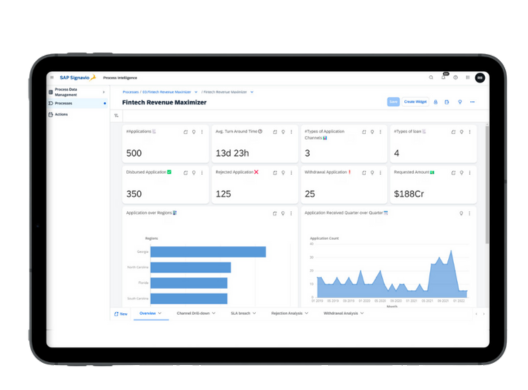

30 Days Free.

Our experts will guide you and uncover actionable process improvement opportunities by seamlessly integrating with your source systems in the trial instance.

Business Review.

We offer solution walk-throughs and process improvement insights, enabling you to evaluate and validate improvements, ensuring measurable return on investment. Experience impactful results tailored to your business needs.

Grow Your Business.

Now that you have validated the solution and business benefits, you can focus on running your business and staying ahead of the competition.

Nancy Elvira

Nancy Elvira

Nancy Elvira

Nancy Elvira